Businesses Are Pressured to Report Their Carbon Emissions

Numerous countries, including the UK, Japan, Canada, and the EU countries, have set legally binding targets to achieve net-zero emissions by 2050. This implies that SMEs and large corporations in these countries need to start managing and reducing their carbon footprint as soon as possible. Additionally, even though reporting emissions is not yet mandatory in every country across the globe, you can expect them to become more widespread and strict.

As a Financial institution who is a trusted partner to these businesses, you could be instrumental in facilitating this transition. By actively supporting the adoption of the Greenhouse Gas Protocol (GHG Protocol), you can assist your customers in navigating the complexities of environmental accountability. All while simultaneously ensuring they remain competitive in an ever-evolving marketplace.

Increasing Regulations Regarding Climate Data

In order to speed up the process of reducing carbon emissions globally, governments are set to impose requirements on businesses in order to meet the targets. For example:

- In the US, the SEC approved a new rule that will require publicly listed companies to disclose climate-related information to their shareholders and the federal government. The rule aims to give investors a clearer picture of the risk that climate change poses to companies. Our CEO Alex Lempka spoke about the impact of the SEC proposal in this FinTech Nexus article.

- In the EU, the law requires certain large companies to disclose information on the way they operate and manage social and environmental challenges. Starting in 2025, the European Union will introduce a transformative change in corporate sustainability reporting with the Corporate Sustainability Reporting Directive (CSRD). This directive replaces the Non-Financial Reporting Directive (NFRD). It signifies a significant evolution in Environmental Social Governance (ESG) disclosure requirements. Moreover, a handful of countries including China, Canada, Singapore, the UK, and the EU countries, implemented carbon taxes and quotas to further pressure businesses to meet the net-zero targets.

Accounting for emissions might seem to be a daunting task, particularly when it comes to large companies with multiple moving parts. However, there are large financial and non-financial incentives toward carbon accounting using the Greenhouse Gas Protocol.

What is the Greenhouse Gas Protocol

The Greenhouse Gas Protocol is a standardised carbon accounting framework. It enables companies of all sizes across the world to accurately account for their carbon emissions. This provides all the tools, methods, and guidance necessary to account for the company’s emissions.

Governments, industry associations, nonprofit agencies, and corporations use it. In 2016, about 92% of Fortune 500 companies employed the protocol, either directly or through a custom program.

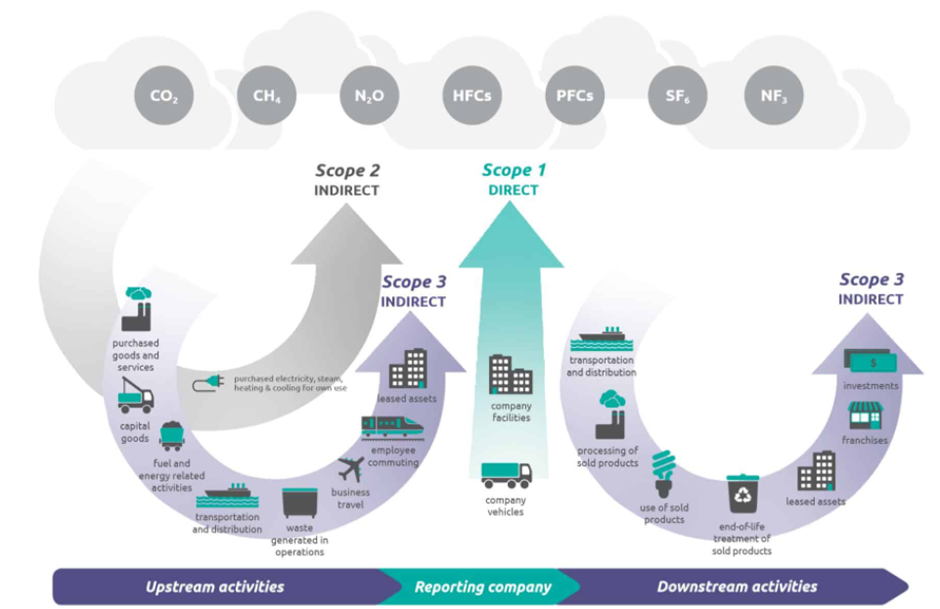

The Greenhouse Gas Protocol breaks down the emissions into 3 scopes (categories):

- Scope 1 outlines the direct emission from the company at sites owned or controlled by them.

- Scope 2 refers to the emissions from the company’s energy (electricity and heat) purchases offsite.

- Scope 3 refers to the rest of a company’s emissions. It includes indirect emissions that are a consequence of a company’s activities, but occur at sources owned or controlled by other companies. Scope 3 also involves both downstream emissions (emissions as a result of the company’s outputs) and upstream emissions (emissions as a result of the material inputs of a company).

You can break each scope down even further to determine which part of your company’s value chain produces the most emissions and where you can make attempts to reduce those emissions.

The GHG Protocol is an invaluable tool for businesses that are looking to understand their environmental impact. It is also useful for stakeholders, including financial institutions, that are looking to understand the risks they are exposed to. A win-win!

How the Greenhouse Gas Protocol an Help Your Business Customers

Accounting for emissions doesn’t just help the overall goal of a carbon-neutral future. You get numerous financial and non-financial benefits from reporting and reducing carbon emissions that can lead to positive outcomes for you and your customers.

1. Catering to Stakeholders

Stakeholders are increasingly aware of the risks that are posed by carbon emissions. When you disclose climate-related information it helps investors, consumers, and other stakeholders to evaluate the non-financial performance of large companies. And, encourage these companies to develop a responsible approach to business.

2. Attract New Investments

The notion that helping the environment has zero financial gains is a myth. Sustainable investing is on the rise. High ESG scores and strong financial performance are correlated.

3. Operational Savings

Your business customers won’t have to spend extra money to compensate for carbon emissions, for example in carbon taxes, if they can start managing and reducing them before it’s too late. Moreover, companies that take sustainable actions can access green funding to support these initiatives.

4. Improve Brand Image

There has been a cultural shift in consumer preference and it is expected to increase. Basically, more and more customers care about the environmental impact of their favourite brands and are willing to switch to climate-conscious alternatives.

5. Gain a Competitive Advantage

Environmental regulations are predicted to affect businesses of all sizes and we are just getting started. Now is the time to use the opportunity to discover how sustainability can give your business customers a competitive advantage.

What’s the Catch?

There are a few problems when it comes to reporting and benchmarking carbon emissions.

- On the one hand, regulations vary significantly across (and sometimes within) countries. For example, the EU uses one set of rules – the Sustainable Finance Disclosure Regulation (SFDR) – but only for financial market participants. In the US, the regulations implemented by the SEC is trying to align with the EU standards. However, there are still many variations in the reporting landscape in different states.

- On the other hand, even though emissions reporting is increasingly common, the reporting mechanisms and standards are still unsatisfactory due to carbon accounting complexity. This is because of organisational boundaries and the difficulties in assessing complex supply chains for scope 3 emissions. This creates confusion for financial market participants looking for reliable and comparable data that they can effectively use for benchmarking.

The bottom line is – without standardisation, comparing emissions brings unreliable results, creates bias and can lead to misinterpretation of the data.

Our Solution

To solve this, Connect Earth developed a rigorous methodology to standardise scope emissions reliably.

In our methodology, we ensure that:

- The organisational boundaries and time period are a fair reflection of the company that is reporting.

- Additional information that allows comparison of this emissions data (e.g. revenue or employee numbers) is reported for the exact same boundary and time period.

- The figures reported are reasonable and are not extreme outliers for the type of company that is reporting.

- The reporting methodology is exactly aligned with the Greenhouse Gas protocol.

Get Started with Connect Earth

At Connect Earth, we aim to foster innovation in the climate space by removing one of the most challenging barriers. That is, the aggregation and standardisation of emissions data. We empower businesses to innovate at a much faster rate by doing the heavy lifting for them through our climate tech infrastructure.

Reach out if you think Connect Earth can assist your financial institution in supporting sustainable practices among your business clients.

__

About Connect Earth:

Founded in 2021, Connect Earth is a London-based environmental data company that democratises easy access to sustainability data. With its carbon tracking API technology, Connect Earth is on a mission to empower consumers and SMEs to make sustainable choices and bridge the gap between intent, knowledge and action. Connect Earth supports financial institutions in offering their customers transparent insight into the climate impact of their spending.